Not known Details About Pvm Accounting

Not known Details About Pvm Accounting

Blog Article

Excitement About Pvm Accounting

Table of ContentsExcitement About Pvm AccountingThe Pvm Accounting DiariesFascination About Pvm AccountingPvm Accounting Can Be Fun For Everyone5 Simple Techniques For Pvm AccountingThe Greatest Guide To Pvm AccountingGetting The Pvm Accounting To WorkPvm Accounting for Beginners

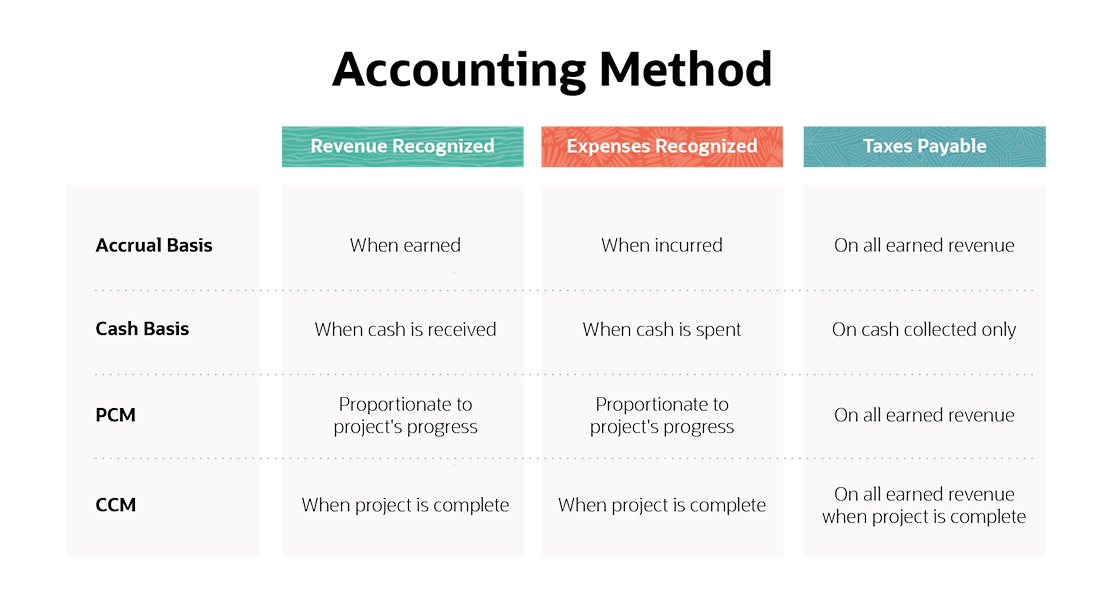

One of the primary reasons for applying audit in building projects is the need for financial control and management. Bookkeeping systems offer real-time understandings into project costs, profits, and success, enabling project supervisors to quickly determine possible concerns and take restorative actions.

Accountancy systems make it possible for firms to keep an eye on capital in real-time, making sure enough funds are available to cover expenses and meet monetary responsibilities. Efficient capital management assists protect against liquidity situations and maintains the task on track. https://www.ted.com/profiles/46928939. Building and construction jobs go through various economic mandates and coverage demands. Correct bookkeeping makes certain that all monetary transactions are taped accurately which the project follows bookkeeping standards and contractual contracts.

The smart Trick of Pvm Accounting That Nobody is Talking About

This lessens waste and enhances task effectiveness. To much better understand the importance of accounting in building, it's likewise necessary to identify between building administration bookkeeping and project management audit.

It focuses on the economic aspects of individual building and construction tasks, such as price estimation, cost control, budgeting, and capital administration for a certain job. Both types of audit are important, and they match each various other. Building administration accountancy makes certain the firm's financial wellness, while project management audit ensures the economic success of private tasks.

Get This Report about Pvm Accounting

A crucial thinker is required, that will function with others to make decisions within their locations of responsibility and to enhance upon the locations' job procedures. The setting will certainly communicate with state, college controller personnel, campus department personnel, and academic researchers. He or she is anticipated to be self-directed once the preliminary discovering curve is conquered.

What Does Pvm Accounting Do?

A Building Accountant is accountable for taking care of the economic aspects of building jobs, consisting of budgeting, expense tracking, financial reporting, and conformity with regulative requirements. They function carefully with project managers, specialists, and stakeholders to guarantee precise economic records, price controls, and prompt settlements. Their expertise in building and construction audit principles, project setting you back, and economic analysis is necessary for reliable economic administration within the building and construction market.

Not known Facts About Pvm Accounting

As you've most likely found out by currently, tax obligations are an inescapable component of doing service in the United States. While a lot of emphasis usually exists on federal and state income tax obligations, there's likewise a third aspectpayroll taxes. Payroll taxes are tax obligations on an employee's gross income. The profits from payroll tax obligations are used to money public programs; therefore, the funds collected go straight to those programs as opposed to the Irs (IRS).

Keep in mind that there is an extra 0.9% tax obligation for high-income earnersmarried taxpayers that make over $250,000 or single taxpayers making over $200,000. Incomes from this tax obligation go toward government and state unemployment funds to aid workers that have shed their tasks.

4 Easy Facts About Pvm Accounting Described

Your down payments must be made either on a regular monthly or semi-weekly schedulean political election you make prior to each calendar year (construction taxes). Monthly payments - https://www.metal-archives.com/users/pvmaccount1ng. A regular monthly repayment must be made by the 15th of the complying with month.

Take treatment of your obligationsand your employeesby making full payroll tax obligation payments on time. Collection and payment aren't your only tax duties.

The Only Guide for Pvm Accounting

Every state has its own unemployment tax obligation (called SUTA or UI). This is since your firm's sector, years in service and unemployment history can all identify the percentage used to calculate the amount due.

Pvm Accounting Fundamentals Explained

The collection, remittance and coverage of state and local-level tax obligations depend on the governments that levy the taxes. Plainly, official site the topic of payroll tax obligations involves lots of relocating components and covers a large range of bookkeeping expertise.

This web site utilizes cookies to enhance your experience while you navigate through the website. Out of these cookies, the cookies that are classified as necessary are saved on your web browser as they are essential for the working of standard capabilities of the site. We likewise use third-party cookies that aid us examine and understand just how you use this site.

Report this page